How is the video game industry doing? This is a common question that underlies much of the business and trade industry press. Individual stocks’ quarterly reports give meaningful anecdotes, but there is not one good benchmark to provide the capital markets’ answer to that question over time. Until now.

Introducing the TriplePoint Video Game Index. It launched today, April 26th, 2021 for investing professionals on the Bloomberg Terminal (ticker: GAMER). Within a few weeks the data should be commonly available on public investing information sites such as Yahoo! Finance and Google Finance under the same ticker. (EDIT 4/27/21: GAMER is now available on Google Finance.)

The index consists at launch with thirty-nine of the most representative global stocks in the video game industry. They are listed below. TriplePoint clients as of May 2021, or their significant subsidiaries, are listed in bold. It should also be noted that The Pokémon Company, though not listed, is a TriplePoint client and a significant subsidiary of Nintendo.

| Activision Blizzard Inc | NetEase Inc ADR |

| Applovin Corp | NCsoft Corp |

| Bandai Namco Holdings Inc | Netmarble Corp |

| Capcom | Nexon Co Ltd |

| CD PROJEKT RED SA | Nintendo Co Ltd |

| Com2uS Corp | Paradox Interactive AB |

| Corsair Gaming, Inc. | Pearl Abyss Corp |

| Cyber Agent Ltd | Perfect World Co Ltd A |

| DeNA Co | Playtika |

| Electronic Arts | Razer Inc |

| Embracer Group AB – B shares | Roblox |

| Enad Global 7 | Rovio Entertainment Oyj |

| Focus Home Interactive | Sega Sammy Holdings Inc |

| Gamania Digital Entertainment Co | Square Enix Holdings Co Ltd |

| GameStop Corp A | Stillfront Group AB |

| Glu Mobile Inc | Take-Two Interactive Software |

| Gravity Co. Ltd. ADR | tinyBuild |

| Gree Inc | Ubisoft Entertainment SA |

| GungHo Online Entertainment | Unity Software Inc. |

| Keywords Studios plc | Wuhu Shunrong Sanqi Interactive Entertainment Network Technology Co (37Games) |

| Koei Tecmo Holdings Co Ltd | Zynga Inc. A |

| Konami Holdings |

EDIT: For the June 2021 rebalancing we added Applovin, Focus Home, Enad & Keywords Studios, now totaling 43 companies.

The TriplePoint Video Game Index is weighted by the size of the company based on their free-floating market capitalization. This is the most common method of modern index development. That means the same percentage move in the stock price of Roblox has proportionally more of an effect on the index’s price than one in one of the currently smaller firms such as tinyBuild.

The index is owned and composed by TriplePoint and is calculated by S&P Dow Jones Indices. As you may recognize from their name, they are the leading provider of index calculation services.

S&P does a calculation of the real-time value of the index every fifteen seconds during United States market hours and distributes that information to a variety of services. The ticker symbol on wire services to see and track this information is GAMER.

We anticipate other services will be picking up the feed of data from S&P Dow Jones and Bloomberg in very short order but it may be up to two weeks from launch.

What Companies are NOT in the index?

There are many companies important to the video game industry but who are not, in our judgement, primarily-to-exclusively engaged in the industry.

Most notably, these include the console makers Sony and Microsoft, who are more critical to the industry than the industry is to them. A closer call to not include in the index is Tencent. Though their stock price is heavily affected by the games industry presence they have, their proprietary social media platform and payments businesses have a meaningful impact on the stock price. We have also chosen not to add semiconductor leaders, important though they are as well.

We have also not included “social casino” stocks and other companies which principally rely on a gambling mechanic. We believe this is not representative of the health of the industry. We have not included entertainment conglomerates that also have significant games divisions but are more affected by other business divisions, such as Disney.

So, How IS the Video Game Industry Doing?

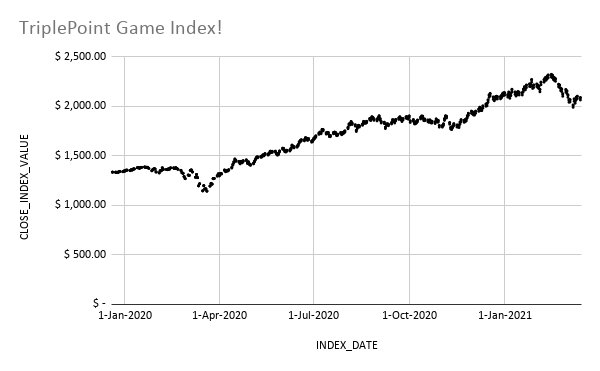

As part of index development, S&P back-calculated the index with the components that were public at the time to the market close on December 19, 2019. This date was chosen as if a normal December “rebalancing” had occurred, and we wanted to get a pre-Covid snapshot of the industry. The further back a back calculation goes however the less reliable and useful it becomes. Many game companies have gone public in the last sixteen months. Their contribution to the index of course occurs only from the time they were public, but no stocks were part of this calculation and subsequently dropped.

We chose the starting value of the industry arbitrarily – but we hope a fun representation of the culture of the industry – at 1337. The index is trading at ~2100 as of this writing, an over 50% gain which has outpaced the broader S&P 500.

The index was not able to add a couple of firms in time for the launch, most notably AppLovin, which had an IPO immediately prior to our own launch. They and likely others will be added to the index during the “quarterly rebalancing” custom indexes do. A company currently on the list that changes their business model from gaming would be dropped from the list for ongoing calculations.

That’s Cool, Can I Invest In It?

While we’d love to have an investible financial product built off this index, there is none built for it at launch. There is no way to invest in any index directly, even the S&P 500. You can invest in products like the ETF SPY, or the futures contract ES that closely hew to it however.

There are several existing ETF (“Exchange Traded Funds”) that do cover a lot of the companies listed above. They also, in our opinion, unnecessarily cover some companies that are not representative of the industry. Investors should examine their holdings to be sure it is reflective of what they are looking to get exposure to. Furthermore, as actively-managed funds with different weights of the components, they cannot provide the first utility TriplePoint was looking for – an objective yardstick such as an index.

We believe wider awareness of the global offerings in video games and their performance will help raise the status of the industry, and help facilitate more capital availability for new and existing game companies. TriplePoint is a leading video game strategic communications firm that is a member of the industry, not just a vendor to it.

We’re excited to partner with S&P to bring this important new metric to the industry.